Personal Finance

Vancouver, Canada — Now that most of my peers and I are about a year or so out of university, the topic of personal finance and investing has been coming up a lot lately as we've finally settled into the part of our lives with a stable full-time income for the first time. Even more so given the state of housing affordability across Canada right now.

The purpose of this post is to collect the details of the financial management methods I've been settled on for a few months to now into one portable document. Something that I can personally use as a reference, and for when the question comes up – explain in complete detail what I've been up to. A financial "my setup/workstation" sort of thing. As well, I believe that discussing money shouldn't be taboo, and being exposed to different methods and points of view can help you find the right path for yourself.

This post is not meant to give advice though, and this isn't supposed to be a model strategy or method, but simply insight into what I've been doing. Perhaps my perspectives and experiences could help you with your own financial planning or, if I'm overlooking something, I could also learn something from you. Anyways, let's get to it.

Debt

So to start this all off, there's my debt. To pay for parts of my schooling I took out a loan and I'm still in the process of paying that back. Straightforward and common enough these days.

My original strategy was to make minimum payments in order to build credit. This was back when I wanted to move back to Toronto and buy a place to live in. While I threw that idea out a while ago and I upped my monthly payments by quite a bit... paying this off is still not exactly a priority for the following reasons.

The first is to again, build credit. The idea keeps getting drummed into my mind by everyone, and to be fair, my plans are notoriously flakey. So who knows, I might end up back in the GTA someday soon, packing a very consistent credit history to boot.

The second is that the interest charged on this loan is lower than the expected (and observed gains) of putting this money into a tax-sheltered account. My logic here is, gains of investment increases > loss of paying interest on loans.

The third and probably the most (financially) impactful reason was that before 2019, you could claim the interest you paid on these loans. This meant that it made more sense to put that into an unregistered investment account too since the interest rate was essentially 0%.

So during 2018 I thought, why stop at investing in my TFSA (RRSP did not apply that year – more on that later) and max my unregistered account contributions too?

Investing

For the 2018 tax year I continued living like a student and poured a good portion of my net income into savings, first my TFSA and then into my margin investing account. I paid the minimum amount on my student loan since interest was claimable. I didn't contribute to my RRSP (asides from the max matched contribution through work). This was because I would only be working for half of the year, so it would be a waste to use the tax deferral benefit on lower brackets.

For 2019 and beyond, that changed. The return for 2018, with student tax credits still applying, yielded me a decent return all of which was used to top off my TFSA. I then began contributing to my RRSP and about midway or so through the year I upped my student loan payments as well. What exactly was going on in those accounts follows.

Passive

Although I had a fun time with some stock picking back in undergrad (thanks, Shopify and others for paying for a semester's worth of groceries one year) after reading books like Wealthing like Rabbits, finding /r/PersonalFinanceCanada, Canadian Couch Potato, Common Sense Investing and the Rational Reminder podcast, I opted to go a passive route with investing, which is delightfully boring.

This approach is shown to be effective over the long run. Index ETFs beat out most active funds – funds which are run by people who put in more time and are far more knowledgeable about trading than I am. So my view is that if they can't beat the market, what makes me think that I can? For more about this, this article goes more into this, using Shopify's CEO Tobe Lütke as an example.

Also, this minimizes the amount of time I spend in that trading space. Personal finance and investing are interesting topics, and learning about them literally pays dividends. But it's not a passion of mine, so I'd like to limit the amount of time I spend in that domain.

Questrade: Registered Investing

For my TFSA and RRSP, I'm invested completely into asset allocation ETFs. I use Questrade for the very simple reason that buying ETFs on that platform does not charge a commission, only minor ECN fees. On a typical monthly purchase this ends up being a few cents.

Given that I sometimes make multiple transfers a month to these accounts along with subsequent purchases, this has saved me a few hundred dollars over using a traditional big bank brokerage. Those $5, $10 commission fees add up!

WealthSimple: Unregistered Investing

For my unregistered investing I was originally using Questrade the same way as mentioned above. However, when I found out that for non-registered accounts, the management fees that are charged for roboinvestors are tax deductible I thought, if there effectively isn't a management fee, and the MER of the underlying ETFs as a whole is about the same as an asset allocation ETF, why not make use of this service?

After a year or so of making tedious manual purchases for every transfer to my Questrade accounts, I began to really see the appeal of using an automated roboinvestor. It makes automatic purchases from all transfers to the account, including buying fractional shares and automatically rebalancing.

It also has tools to help you save more – which is the most important part. When I make a purchase on my credit or debit card, the amount that it would take to round that purchase to the nearest whole dollar is collected and automatically deposited into my account weekly. Plus, if an account reaches over a threshold balance, the extra is skimmed off and deposited monthly too.

These two funding tools and my monthly auto deposit work together to invest constantly, and consistently. It removes the friction and emotion from making these purchases, preventing me from asking myself questions like "Maybe I can time the market if I hold off right now?" and answering with something regretful.

So I sold off everything in that account and transferred it to a Wealthsimple invest account.

Miscellaneous

Tools

The only other tool I use for personal finance would be YNAB (You Need a Budget), which I honestly live by. I originally used a Mint account – and I still do for some macro level tracking. But YNAB blows Mint out of the water for actual budgeting purposes.

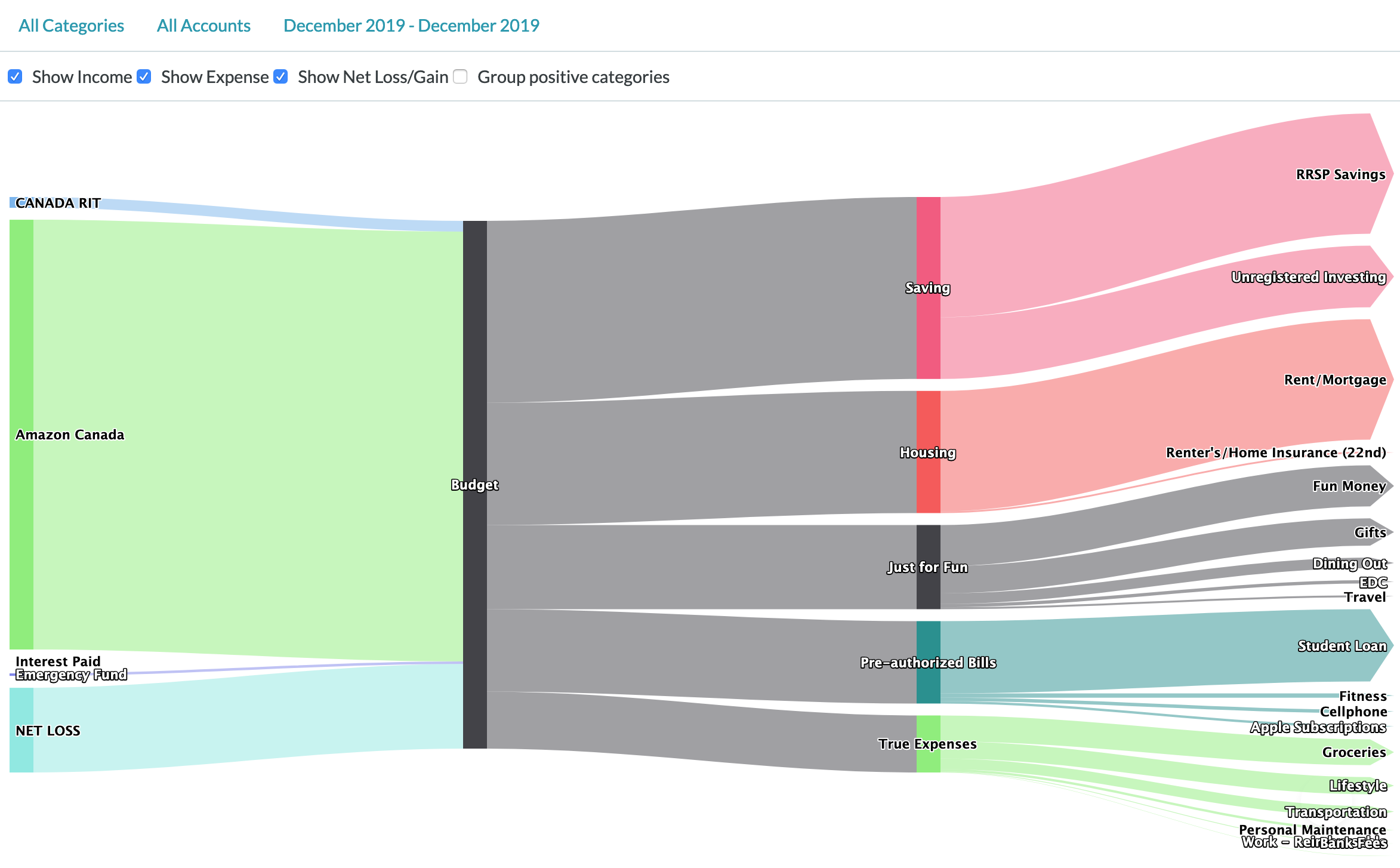

They're similar in that they both connect to your accounts and auto sync transactions (if you want). But with YNAB, since you have to budget for categories ahead of time and manually approve individual transactions as they come in (don't worry, they're auto categorized) I find it really keeps me on top of my spending. You can also add features like this income/expense breakdown to see your whole financial picture at a glance, using my December 2019 spending as an example.

It's not cheap at $84USD a year, but in one month it kept me from spending far more than that on eating out – so, worth it in my opinion. Plus I personally found Mint to be bad in Canada. I have to constantly log into accounts again, it doesn't update transactions automatically if you haven't logged in in a while and the UI in Canada hasn't been updated in a decade unlike in the States.

Emergency Fund

Everyone needs an emergency fund, and the exact size of that fund depends on how much your monthly expenses are (trivial to figure out if you use Mint or YNAB), your income stability and how much your peace of mind is worth. I err on the side of a larger fund given the lack of safety net in my life.

I originally kept my emergency fund in a Tangerine Savings account, but as of January 2020 Wealthsimple introduced a cash account with a higher interest rate. I opened one of those and moved all my money there.

Conclusion

So that's my personal finance situation summed up in a thousand or so words. Hopefully you learned a thing or two from this. If you did, or want to use any of the services mentioned, these are my referral links below, with what you get for using them added after.

- WealthSimple – $10 000 managed free for 12 months

- Questrade – cash bonus depending on amount deposited (up to $250)

- YNAB – free month

On top of that, here are a couple books that taught me almost everything I know about personal finance and financial accounts/instruments.

Wealthing Like Rabbits explains pretty much everything you'd need to know about the basic fundamentals of finance and investing for personal retirement from a Canadian perspective. This includes going over the financial accounts the government provides to help you with that task, ie. the aforementioned TFSA and RRSP. In my opinion it's a complete shame that this isn't taught in a mandatory high school course.

The second and more controversial (at the family dinner table) is The Wealthy Renter, which is pertinent for the equity-less Gen-Zs/Millenials just entering the workforce and entering a period of sky-high property/rental prices. There's the common notion that renting is "throwing out your money", yet many overlook that the money you put into property does not go directly into building equity for you either. This is something this book goes into detail about and can help quell some anxiety. Again, from a Canadian perspective.

That's enough for now though, thanks for reading!